AAVE rallied as much as 25% today, fueled by growing optimism across its ecosystem and a spike in trading activity.

Aave (AAVE) soared to an intraday high of $269 on May 20 afternoon Asian time, marking its highest level since February and making it one of the top-performing cryptocurrencies in the market right now. From its April low, AAVE has now climbed more than 132%.

The surge came alongside a spike in trading volume. According to data from crypto.news, over $800 million worth of AAVE changed hands today, its most active day since early March.

Meanwhile, AAVE’s futures open interest hit an all-time high of $569 million, reflecting strong demand from derivatives traders. Its positive funding rate for two straight weeks also suggests the majority of the market is still betting on more upside, with long traders currently paying short traders.

Traders appeared to welcome progress on the GENIUS Act, which recently cleared a key procedural vote in the U.S. Senate. The bill proposes a regulatory framework for stablecoins, an area critical to DeFi protocols like Aave.

Given Aave’s reliance on stablecoins like USDC, DAI, and its native GHO, the prospect of regulatory clarity could encourage more institutional participation and bolster confidence across its ecosystem.

AAVE also got a boost from solidifying its lead as the top DeFi protocol by TVL. According to DeFiLlama, its total value locked jumped nearly 40% in the past month to reach $40.7 billion, far surpassing Lido, which has $23.3 billion.

This growth is translating into real revenue. AAVE has raked in over $250 million in fees year-to-date, putting it among the most profitable protocols in the space.

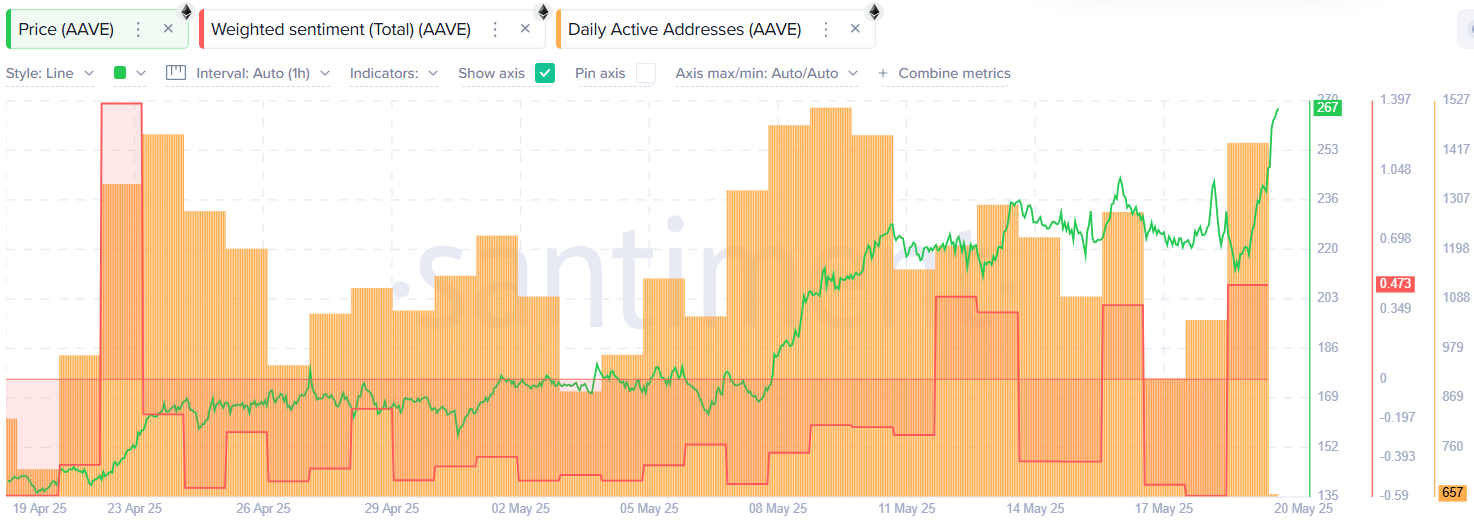

Momentum on the technical front is also being matched by a rise in daily active addresses, which have spiked 57% over the past two days.

At the same time, its weighted social sentiment has also flipped positive, a sign that market participants are growing bullish on AAVE’s short-term outlook.

Potential golden cross in development

On the 1-day/USDT chart, the Aroon Up indicator is at 100% while Aroon Down sits at 0%, meaning bullish momentum is dominant. The Chaikin Money Flow Index is reading 0.26, which signals more capital flowing into the token.

A golden cross also looks imminent on the daily chart, as AAVE’s 50-day and 200-day moving averages inch closer to a crossover, often considered a bullish signal.

The token is nearing the 61.8% Fibonacci retracement level at $271.35. A clean breakout above this level could pave the way toward the 50% retracement level at $347.19, roughly 30% higher than current levels.

On the flip side, if a pullback happens, key support lies near $226.45, which could serve as a solid bounce zone before the uptrend resumes.

At press time, AAVE was trading around $267 per coin.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.