US President Donald Trump continues to state that the nation’s central bank keeps the interest rates too high and urged for another cut.

Unlike the previous similar occasions, though, he was rather radical this time, claiming that the Federal Reserve needs to slash the rates by at least three points.

First, President Trump mentions that higher rates are costing the US more money on interest expense.

At a high level, this is true.

Annual interest expense on US debt has reached $1.2 TRILLION over the last 12 months.

The US is now paying $3.3 BILLION in interest per day. pic.twitter.com/22N9M2PdFX

— The Kobeissi Letter (@KobeissiLetter) July 9, 2025

According to the Kobeissi Letter, the US now pays well over $3 billion in interest alone per day. If Trump’s recommendation is followed by the Fed, then, he said, it would save $360 billion per year.

However, the analysts at Kobeissi said the only debt that matters is the public one, which is at around $29 billion. Their analysis claims that if the rates on that entire amount are cut by 300 bps, the “US could save $290B x 3 = $870B/year.”

“However, refinancing all of this debt immediately would be impossible. Realistically, 20% could be refinanced in year 1 to save ~$174B.”

Although these numbers sound promising, there are certain drawbacks to such a potential rate cut, especially when it comes to inflation. It would be three times bigger than the current record seen in March 2020, when the Fed reduced the rates by 100bps.

This would come with a US economy that is already growing at +3.8% YoY.

As a result, we would expect to see a resurgence in CPI inflation, likely exceeding 5%.

And, while it would initially send stocks higher as seen in March 2020, there’s no such thing as “free money.” pic.twitter.com/K5vRmp8Ay8

— The Kobeissi Letter (@KobeissiLetter) July 9, 2025

The Kobeissi Letter further warned that mortgage rates would drop from 7% to 4% into a market that “has already seen prices rise +50% since 2020.” The analysts suggested that prices can surge by another 25%.

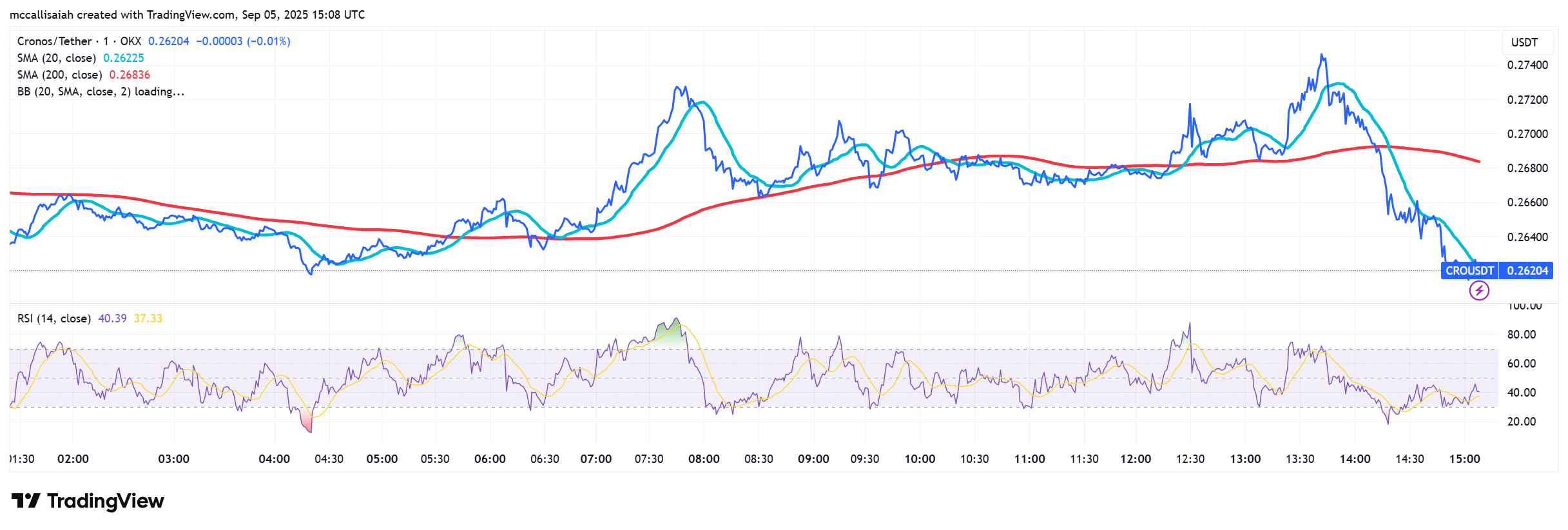

Nevertheless, such a move should be highly beneficial for riskier assets like bitcoin. The cryptocurrency’s price is up by around 1% in the past day, and since Trump’s recommendation, it now stands close to $110,000.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!