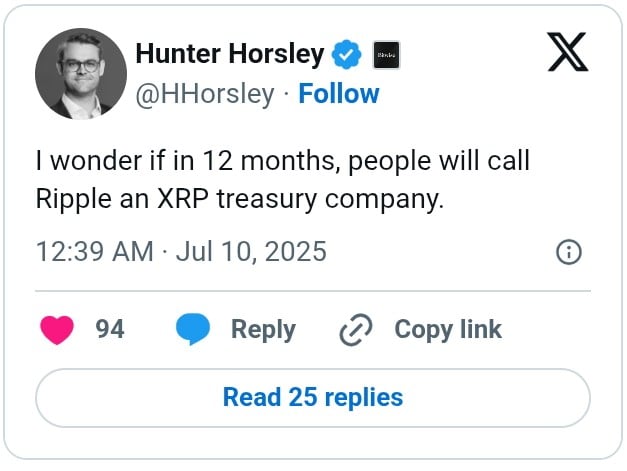

- The CEO of Bitwise Investment has asked whether Ripple could be labeled as the treasury company of XRP.

- Ripple boss Brad Garlinghouse has confirmed that the company owns $100 billion worth of XRP.

XRP is back in the news as Bitwise CEO Hunter Horsley asks about the possibility of people labeling Ripple as an XRP treasury company in 12 months. Replying to this, an X user identified as Big Mykel highlighted that Ripple is already the “MicroStrategy for XRP”. However, he believes that the company may not admit it.

Another user known as Raph explained that Ripple could be referred to as the “OG Treasury company” as institutions like Trident are raising millions for the XRP treasury.

The Background of this Discussion

This latest discussion stems from the growing corporate trend in crypto. In Ripple’s first quarter report, it was stated that the company’s holding was around 4.56 billion XRP. Meanwhile, another 37 billion XRP is reportedly kept in escrow.

Just recently, Ripple boss Brad Garlinghouse also disclosed that the company owns about $100 billion worth of XRP. In an interview with the director of financial technology research at JMP Securities, Devin Ryan, Garlinghouse stressed that this should be considered when determining the company’s valuation.

Companies with XRP Treasury Plans

As indicated in our recent news brief, eight heavyweight companies have currently declared their XRP treasury plans. One of them is the Singapore-based Web3 company, Trident Digital Tech Holdings, seeking to commit up to $500 million to this initiative.

Apart from them, a Nasdaq-listed Chinese Artificial Intelligence (AI) firm, Webus International has disclosed that it is establishing a strategic XRP reserve with up to $300 million. According to the company’s CEO, Nan Zheng, this is part of the plans to transform both domestic and international operations, as noted in our earlier discussion.

These strategic developments have the potential to create a powerful synergy between our domestic and international operations. The integration of an XRP blockchain has the potential to revolutionize how we handle cross-border payments for both partners and travellers worldwide.

In a recent update, CNF also highlighted that VivoPower International has raised $121 million in a private share placement to launch an XRP treasury strategy. Similarly, Florida-based pharmaceutical distribution company Wellgistics has secured a $50 million credit line to support treasury management using XRP. As noted in our previous post, this is to cut costs and speed up cross-border transactions across the supply chain.

In the long run, Chief Analyst at Bitget Research Ryan Lee believes that XRP could leverage on these to cross the $5 mark.

The surge in corporate XRP treasuries signals a growing institutional embrace of XRP for its low-cost, high-speed payment capabilities.

At the time of writing, XRP was trading at $2.44 after surging by 4.5% in the last 24 hours. This has extended its weekly gains to 6% while its monthly returns stand at 5%.

According to our data, the XRP’s trading volume has recorded a whopping surge of 90% with $5.6 billion changing hands. As mentioned in our last analysis, analyst Egrag Crypto has predicted that the price could rise to $17 in the bullish cycle.