TL;DR

- XRP/BTC breaks 7-year range, signaling potential shift toward historical runs last observed in 2017.

- Ripple is close to settling with the SEC; ETF talks intensify as the market closely watches August developments.

- Whale wallets buy 60M XRP in 24 hours, adding $180M in buying pressure across exchanges.

- XRP trades at $3.10, which is close to its recent ATH; an analyst suggests a true breakout above $26.

XRP/BTC Breakout Ends 7 Years of Consolidation

XRP has broken out of a price range it held against Bitcoin for nearly seven years. According to crypto analyst Cas Abbé, XRP/BTC had been consolidating since 2018, with price movement largely sideways during that period. The pair has now moved above a long-term resistance level around 0.000035 BTC, a level that held for most of the consolidation phase.

XRP/BTC has now been consolidating for almost 7 years now.

The SEC case is over, and XRP spot ETFs are coming.

This might be the catalyst which could result in a breakout.

And once that happens, $XRP will rally like Q4 2024.

And maybe, it could go from top 3 to top 2 coin… pic.twitter.com/rKnjiVlL3I

— Cas Abbé (@cas_abbe) July 30, 2025

Interestingly, this breakout is drawing comparisons to XRP’s 2017 performance, when the token surged to the number two spot by market cap. XRP/BTC is currently testing a zone last visited during that cycle, between 0.00019 and 0.00023 BTC.

The analyst even hinted that XRP’s potential rise could take it to the number 2 spot in terms of market cap, meaning that it could flip ETH.

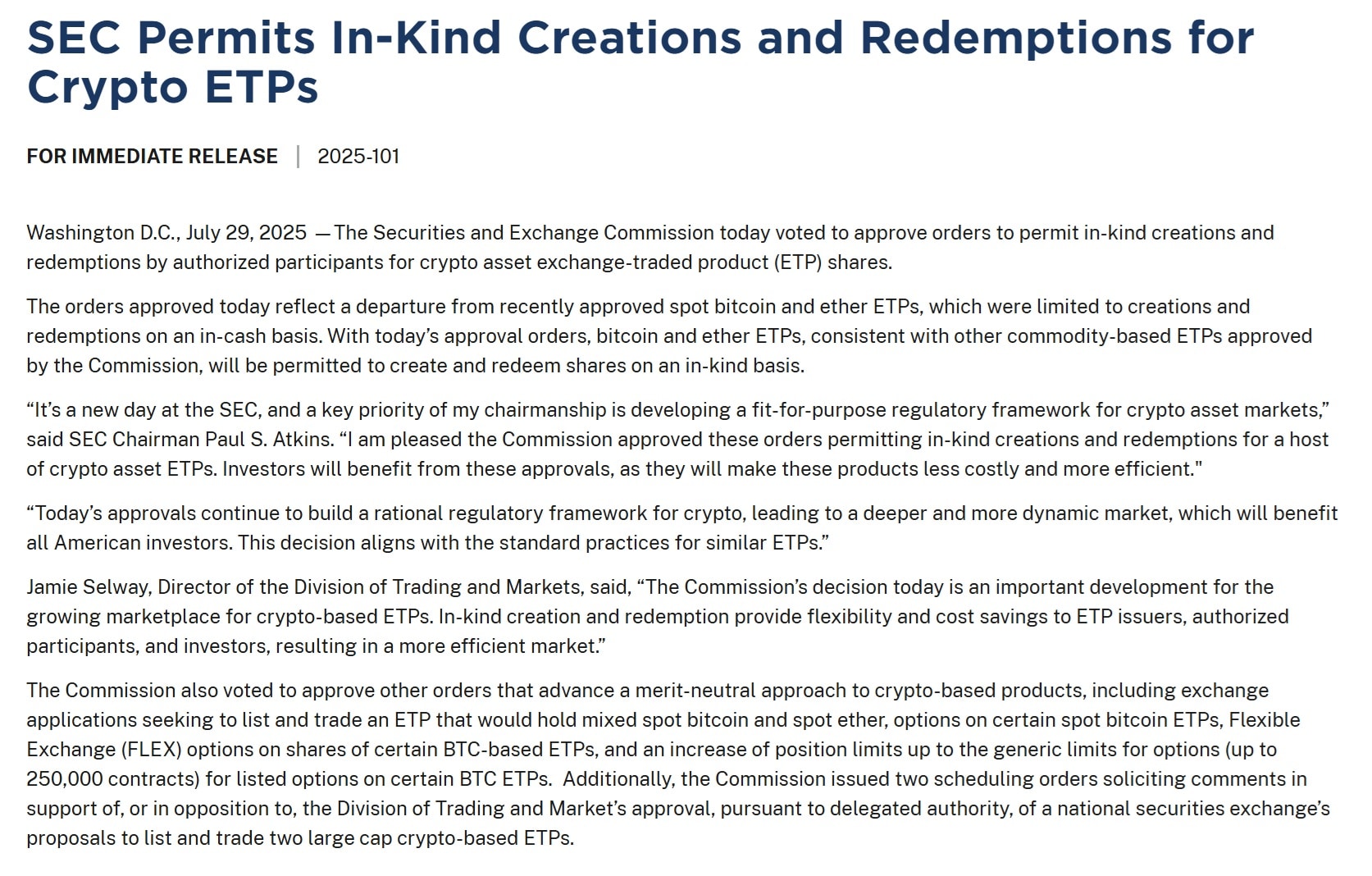

Legal Developments and ETF Speculation Fuel Momentum

Ripple’s legal case with the US SEC has reached a new stage. The two parties agreed to reduce the originally proposed $125 million fine to $50 million.

In addition, the injunction blocking Ripple from institutional XRP sales has been removed. A previous 60-day negotiation window ended in June, and a final extension is expected to close in August.

While some in the community expect a key update by August 15, legal analyst Bill Morgan clarified that the SEC has no formal deadline to drop its appeal by that date. Despite this, market participants continue to monitor legal progress closely, especially as talk of a spot XRP ETF gains attention.

The SEC has not withdrawn the Appeal in the Ripple matter yet. There is no deadline on the SEC to withdraw the appeal however the SEC needs to report to the appeal court by 15 August 2025, which acts as a deadline for the SEC to do something although it may just ask for more…

— bill morgan (@Belisarius2020) July 29, 2025

An approved ETF could expand access to XRP and possibly trigger further capital inflows, similar to what was seen with Bitcoin and Ethereum ETFs earlier in the year.

Market Activity, Whale Buying, and Network Signals

XRP was trading at $3.10 at press time, with a 24-hour trading volume of $5.6 billion. The token has seen a minor decline in the past 24 hours and an 11% drop over the last week. Its market cap currently stands at $183.5 billion, ranking it as the third-largest crypto asset.

On-chain analyst Ali Martinez reported that large holders bought 60 million XRP in the past 24 hours, a total worth over $180 million. This follows a steady rise in whale accumulation, with large investors increasing exposure over the last month.

In addition to price action and volume, on-chain indicators are signaling a possible continuation. Analyst Captain Redbeard reported that XRP’s NVT ratio, used to measure network value versus transaction volume, has dropped to multi-month lows while the price has continued to climb. This pattern last appeared before a strong XRP rally, suggesting a potential breakout setup.

Price Gaps and Criminal Case

Analyst Amonyx pointed out that XRP’s previous all-time high against Bitcoin would place its current USD value near $26.6. With XRP still priced at $3.10, the difference between current levels and historical peaks remains wide.

Separately, a criminal report involving XRP has emerged. Nancy Jones, the widow of country music artist George Jones, filed a report claiming $17 million worth of XRP was stolen. Her ex-boyfriend, Kirk West, was arrested at Nashville International Airport on July 24 in connection with the case.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!