Bitcoin hasn’t hit its peak, according to Fundstrat co-founder Tom Lee. Come January 2026, expect a new all-time high if the Federal Reserve pivots from quantitative tightening.

Summary

- Tom Lee predicts Bitcoin hasn’t hit its peak and expects a new all-time high by January.

- “I don’t think the Bitcoin high is in place,” Lee said.

- Historical precedent suggests that QT endings catalyze rapid market rallies, fueling Lee’s optimism for both Bitcoin and equities.

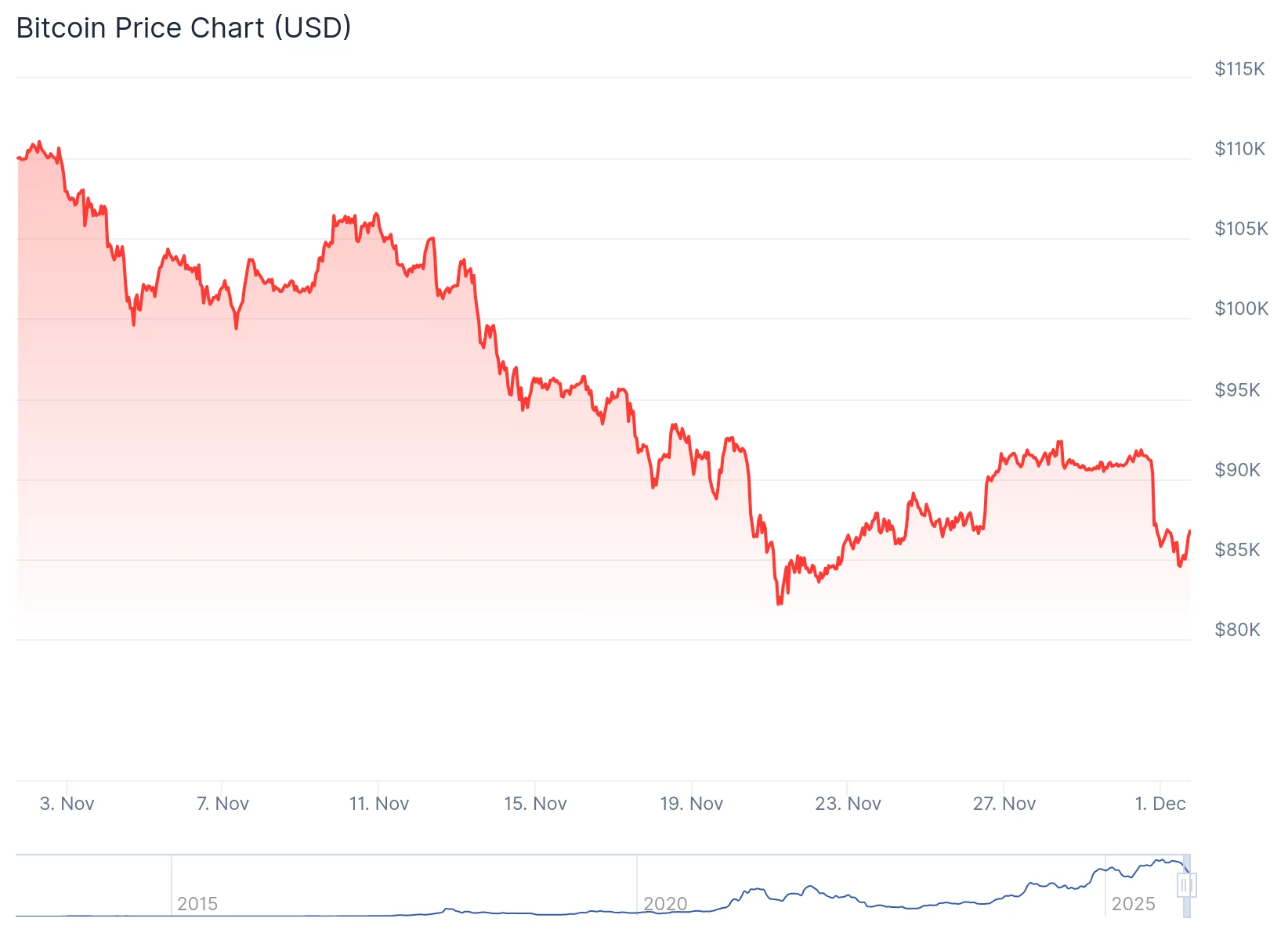

Despite the downturn in November, Lee predicts Bitcoin (BTC) will recover and “make a new all-time high by January.”

In an appearance on CNBC, Lee explained that “today is the day that QT ends,” referring to the Fed’s long-running quantitative tightening.

Historically, Lee notes, when the Fed paused QT in September 2019, markets rallied 17% in just three weeks. If history repeats, Bitcoin could be ripe for a rally.

As for December, expect investors to warm up to Bitcoin again as the Federal Reserve changes its stance — “a tailwind” for Bitcoin and equities alike.

“I don’t think the Bitcoin high is in place,” Lee said.

Bitcoin has a ways to go

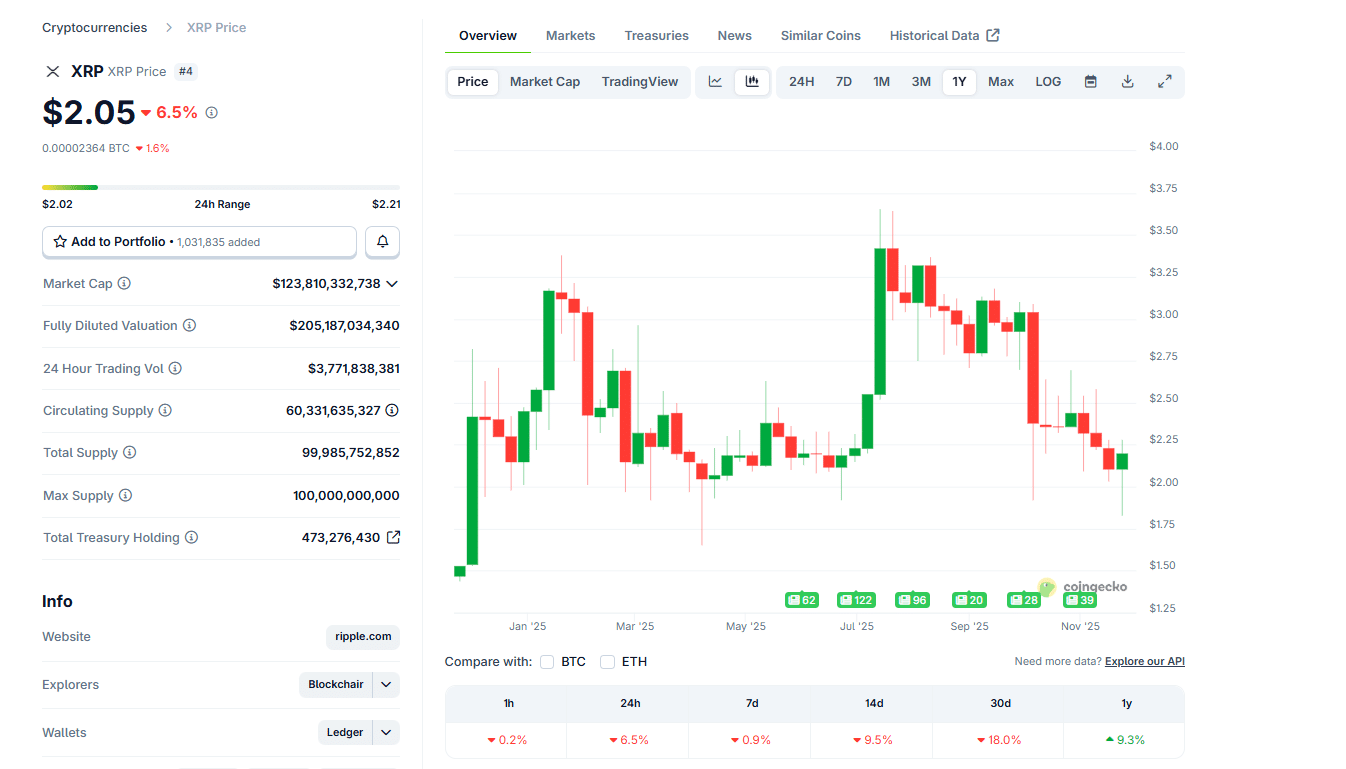

Top crypto analysts remain bullish on Bitcoin even though it is currently languishing at just above $86,700, down over 21% from a month ago. See below.

Lee maintains that the coin will ultimately soar to the psychological point of $100,000 by the end of the year.

He also expects Bitcoin to ultimately soar to its all-time high in 2026 and possibly reach $200,000. He cited factors such as potential Federal Reserve interest rate cuts and growing institutional demand in the US and other countries.

Lee has become a significant investor in the crypto industry through BitMine. The company, of which he is chairman, has become the largest holder of Ethereum (ETH).