Another Friday has rolled around, which means more crypto options contracts are expiring as spot markets take a breather from recent volatility.

Around 37,000 Bitcoin options contracts will expire on Friday, Dec. 5, and they have a notional value of roughly $3.4 billion. This expiry event is much smaller than recent ones, so there is not likely to be any impact on spot markets, which have stabilized somewhat after Monday’s sell-off and quick recovery.

US government economic data is flowing again, and labor market and employment data look a little gloomy, which is good news for Federal Reserve rate cut expectations next week. The probability of a 0.25% rate cut on December 10 has now increased to 87% according to CME futures.

Bitcoin Options Expiry

This week’s batch of Bitcoin options contracts has a put/call ratio of 0.94, meaning that longs and shorts are almost evenly matched. Max pain is around $91,000, according to Coinglass.

Open interest (OI), or the value or number of Bitcoin options contracts yet to expire, is highest at $100,000, which has $2.7 billion at this strike price on Deribit. There is also almost $2 billion in OI at $80k and $85k targeted by short sellers. Total BTC options OI across all exchanges is at $55 billion, according to Coinglass.

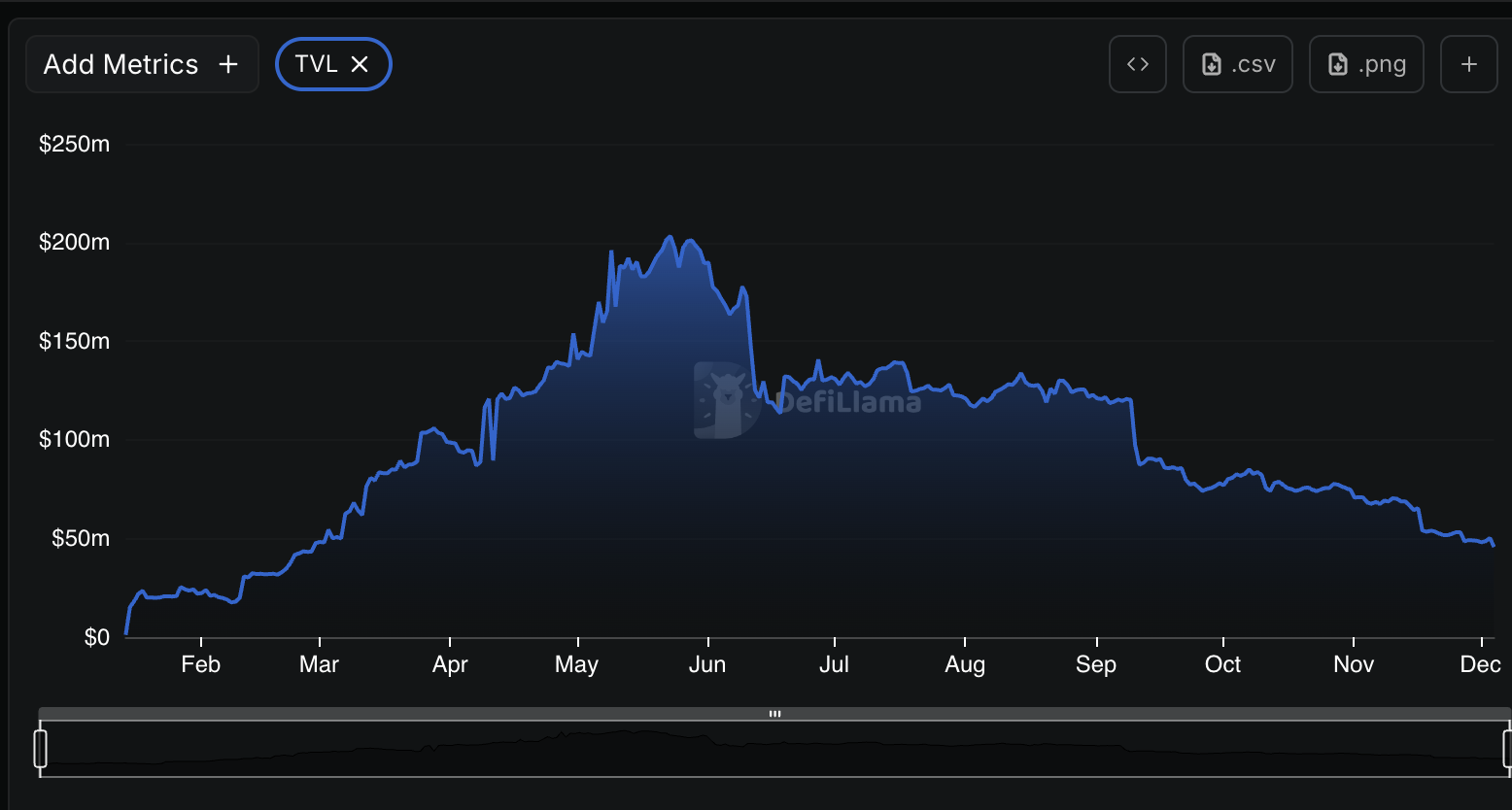

The options market has continued to develop as institutional participation has grown significantly in 2025, reported Levitas on Thursday.

Bitcoin options on Deribit recorded their highest monthly volume in October 2025 at 1.49 million contracts, followed by November at 1.33 million, it stated. Year-to-date Bitcoin options volume stands at 10.27 million contracts, not including December, which is a 36% increase from 2024.

In 2025, the options market has continued to develop as institutional participation has grown significantly.

On Deribit, BTC options recorded their highest monthly volume in October 2025 at 1.49M contracts, followed by November at 1.33M. Year-to-date BTC options volume stands… pic.twitter.com/AlBVIBuO6F

— Laevitas (@laevitas1) December 3, 2025

You may also like:

Earlier this week, crypto options provider Greeks Live said the group shows a cautiously bullish bias “with traders calling bottoms and expecting upside, though sentiment is tempered by frustration over choppy price action and false moves.”

“Key focus remains on whether current levels around $95k-$100k represent the final bottom, with traders watching BTC term structure and put skew showing bearish positioning despite bullish calls.”

In addition to today’s batch of Bitcoin options, around 210,000 Ethereum contracts are also expiring, with a notional value of $667 million, max pain at $3,050, and a put/call ratio of 0.78. Total ETH options OI across all exchanges is around $11.3 billion. This brings Friday’s combined crypto options expiry notional value to around $4 billion.

Spot Market Outlook

Crypto markets have retreated slightly over the past day, with total cap falling 1.7% to $3.23 trillion. Bitcoin has failed to break resistance at $93,000, falling below it at the time of writing. Resistance for Ether remains at $3,200, with the asset trading at $3,177 at the moment.

Altcoins are taking bigger hits with heavier losses for XRP, Solana, and Hyperliquid.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).