- Ripple’s boss discloses that the company has applied for a national bank charter following a similar move by stablecoin issuer Circle.

- An analyst has disclosed that this could significantly impact the price of XRP.

CNF previously reported that the Office of the Comptroller of the Currency (OCC) has rescinded certain decisions to create easier banking access for crypto firms.

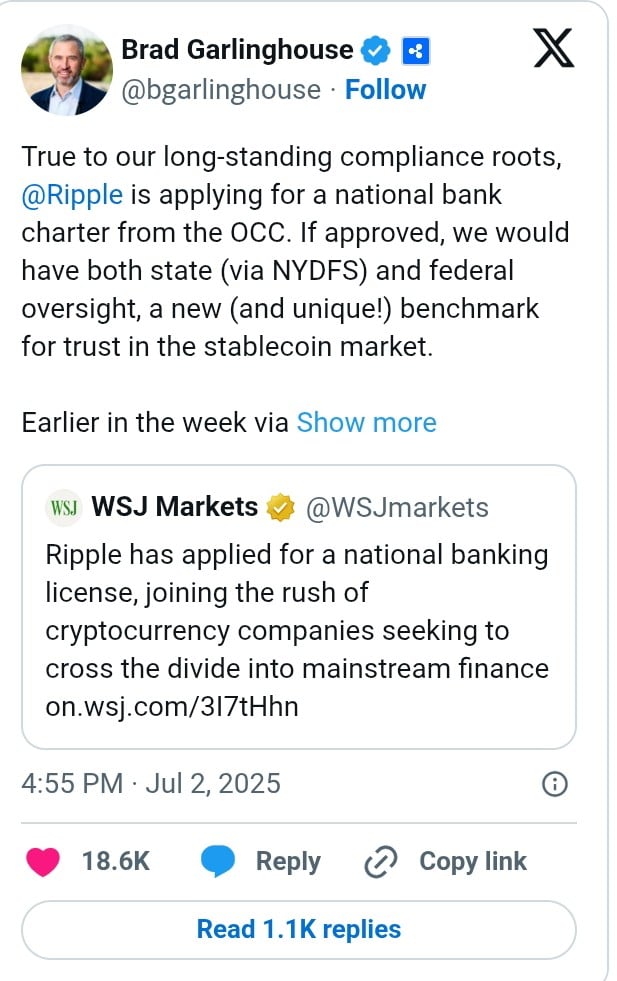

Months later, Ripple CEO Brad Garlinghouse has confirmed that the blockchain company has filed an application for a national banking license with the OCC. According to multiple reports, this strategic move is meant to put Ripple’s stablecoin RLUSD under the remit of the OCC.

Commenting on this, Jack McDonald, Senior Vice President of Stablecoins at Ripple, highlighted that this regulation increases transparency and compliance in the stablecoin market. Similarly, Garlinghouse explained that the license would be a “new benchmark for trust in the stablecoin market” if approved.

In his post, Garlinghouse disclosed that Ripple has also applied for a master account with the Federal Reserve, which would give it access to the central banking system.

This access would allow us to hold RLUSD reserves directly with the Fed and provide an additional layer of security to future-proof trust in RLUSD…Congress is working towards clear rules and regulations, and banks (in a far cry from the years of Operation Chokepoint 2.0) are leaning in.

Currently, RLUSD has a market cap of $469 million, while Tether (USDT) has a valuation of $158 billion. Fascinatingly, Garlinghouse believes that RLUSD stands out in the over $250 billion market by prioritizing regulation and setting the right standard.

Previous Move by Circle and XRP’s Potential Surge

Ripple’s OCC application positions it alongside Circle, which also filed a similar application on June 30. According to Circle co-founder, Chairman, and CEO Jeremy Allaire, applying for a national trust charter is part of the steps to strengthen its infrastructure.

Further, we will align with emerging U.S. regulations for the issuance and operation of dollar-denominated payment stablecoins, which we believe can enhance the reach and resilience of the U.S. dollar, and support the development of crucial, market-neutral infrastructure for the world’s leading institutions to build on.

Commenting on this, an analyst identified as AltcoinBale highlighted that an approval of the banking license could significantly impact the price of XRP to a new high.

When Ripple is granted a banking licence, the price of XRP will never be the same again.

At the time of writing this article, XRP was trading at $2.29 after surging by 4.6% in the last 24 hours, 5% in the last seven days, 3.9% in the last 30 days, and 12.5% in the last 90 days. When this momentum is sustained for a longer period, XRP could likely reach $14, as noted in our earlier news brief.

In a recent update, CNF reported that XRP has shown the potential to record a 5x surge from the current price. According to another analysis, this surge could be fueled by the potential approval of the spot XRP ETF applications.