XPL crypto

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

.cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) {

stroke: #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-trend.positive {

color: #008868 !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive {

border: 1px solid #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.positive::before {

border-bottom: 4px solid #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) {

stroke: #A90C0C !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative {

border: 1px solid #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.negative {

color: #A90C0C !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-trend.negative::before {

border-top: 4px solid #A90C0C !important;

}

0.53%

Plasma

XPL

Price

$0.1956

0.53% /24h

Volume in 24h

$66.75M

<!–

?

–>

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

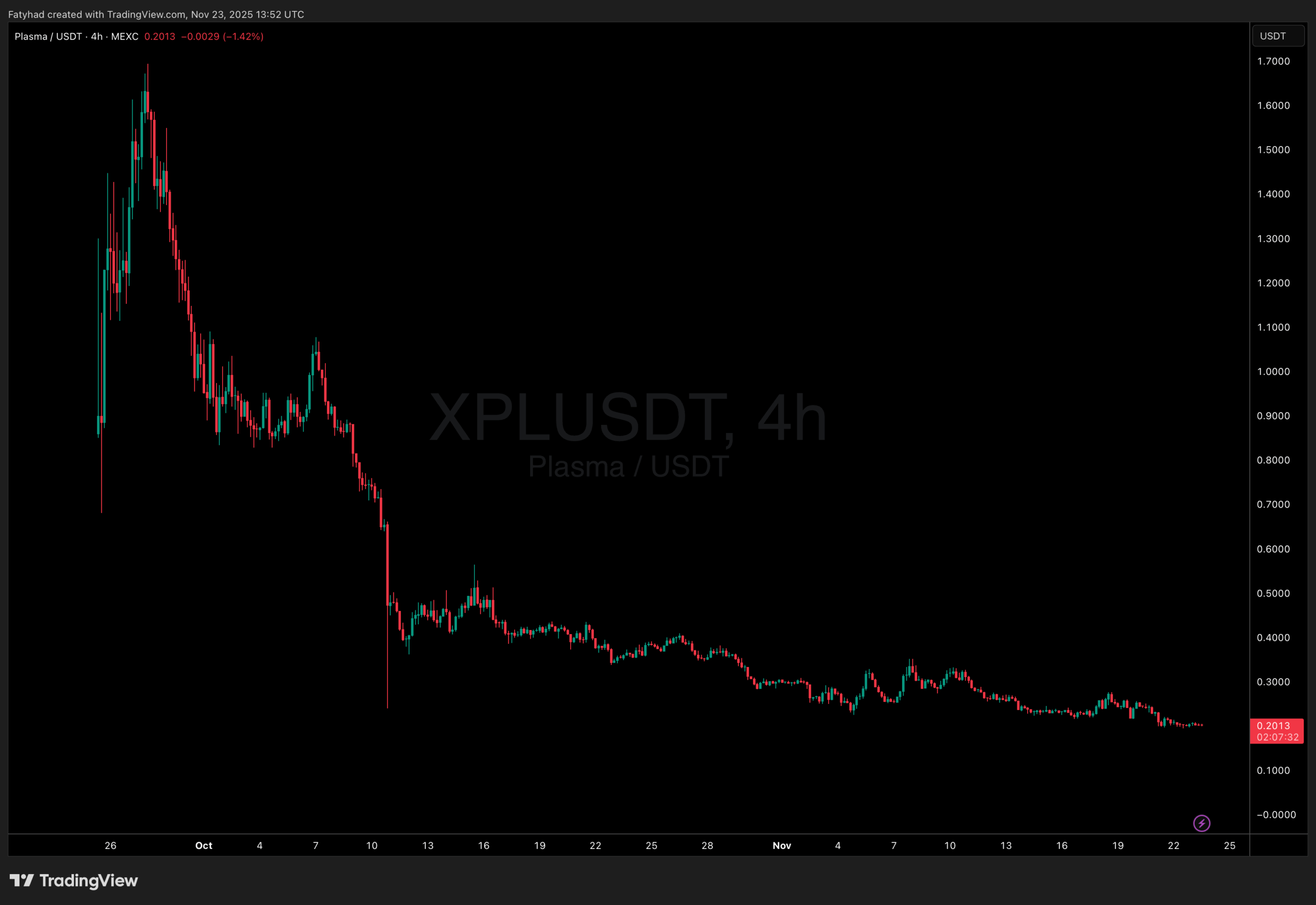

launched in late September 2025 as a new Layer-1 blockchain built especially for stablecoin payments. With backing from Peter Thiel, Tether, and Bitfinex, it started strong. Within two weeks, the chain held over $6.3Bn in stablecoins and reached a total value locked (TVL) close to $8.4 billion. The native token XPL traded above $1.50 at its peak. But now it seems like all the hype just… faded.

Btw what happened here, in a week stablecoins supply on Plasma nuked from 5b to 1.4b pic.twitter.com/9mcsqEZWxn

— ieaturfood (@ieaturfoods) November 23, 2025

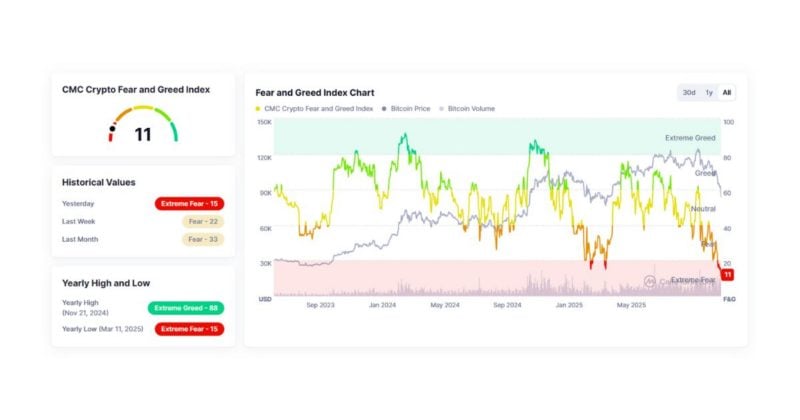

Six weeks later, the picture looks very different. As of November 23, 2025, XPL trades near $0.20, down more than 85% from its high. Stablecoin supply on the network has fallen from $6.3Bn to $1.78Bn, and overall TVL sits at $2.7Bn.

EXPLORE: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

Why Early Yield Farming Couldn’t Save XPL Crypto

Most of the early growth came from yield farming. Around 65 % of the stablecoins on Plasma were deposited into lending protocols to earn XPL rewards. When the price of XPL began to drop, those rewards became worth much less in dollar terms. Users began withdrawing their stablecoins and transferring them to other chains, resulting in a steady outflow that persists to this day.

EXPLORE: PIPPIN Erupts +263% in 24 Hours – Could This Be the Best New Crypto to Buy Right Now?

Additional pressure comes from the token supply schedule. New XPL tokens are released regularly to early investors and the team. This ongoing increase in circulating supply, combined with lower demand, has pushed the price lower almost every week. $18.13M worth of XPL tokens is set to unlock next week, representing the largest upcoming release.

Daily transaction counts on Plasma remain high, but most stablecoins that stay on the chain are still parked in lending pools rather than being used for payments or transfers. Without more real-world use cases, many observers expect the outflows to continue.

(Source: Coingecko)

If XPL hits around $0.224 or $0.23, we could see a short squeeze, where individuals who bet against the token are forced to buy it back to cover their positions, potentially driving the price higher.

In short, Plasma attracted a large amount of capital very quickly through high farming rewards. Once those rewards lost value and new tokens continued to enter the market, users began to leave.

The project now needs stronger day-to-day usage of its stablecoin features to stop the decline and rebuild confidence.

DISCOVER: Top 20 Crypto to Buy in 2025

Key Takeaways

- XPL’s 85% crash stems from unwinding yield-farming incentives, shrinking stablecoin liquidity, and a major $18.13M token unlock that’s pressuring price.

- Unless real stablecoin usage grows, Plasma risks continued outflows, though a move toward $0.224–$0.23 could trigger a short-squeeze rebound.

The post Plasma (XPL Crypto) Loses 85 % of Its Value in Six Weeks: What Happened? appeared first on 99Bitcoins.