Key Takeaways

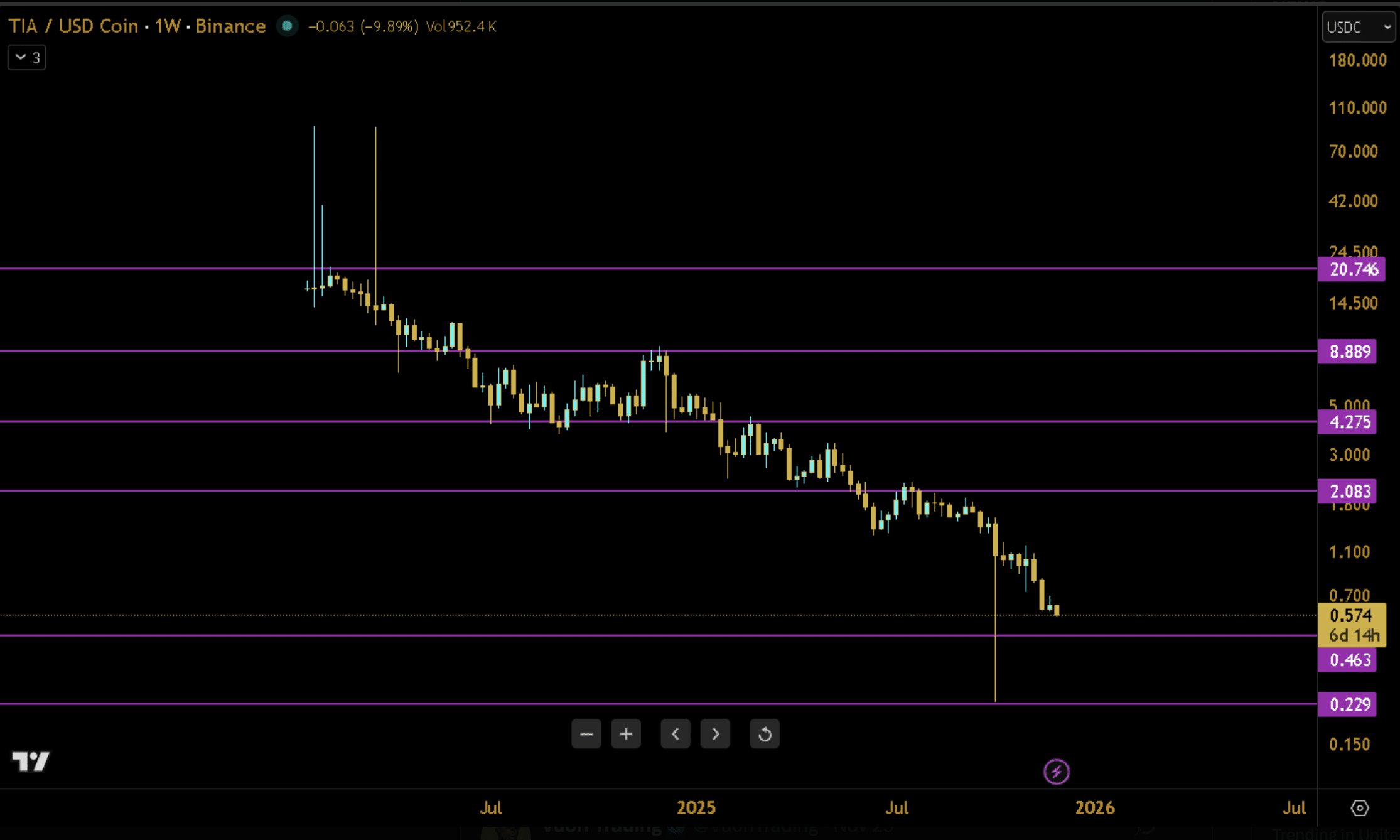

- Hyperliquid’s HIP-3 custom markets have surpassed $5 billion in trading volume.

- HIP-3 allows users to create and trade custom perpetual markets, including synthetic stock indices, without needing permission.

Share this article

Hyperliquid’s HIP-3 custom markets have generated over $5 billion in trading volume as the decentralized perpetuals exchange expands beyond traditional crypto derivatives.

HIP-3 enables users to create and deploy custom perpetual markets for assets like synthetic stock indices without requiring permission. The upgrade has facilitated new markets linked to major tech stocks, contributing to increased trading activity across the platform.

Hyperliquid operates on its own layer-1 blockchain, specializing in high-performance trading of crypto derivatives and synthetic assets. The exchange aims to rival centralized platforms through enhanced decentralization efforts and smoother trading features.

Builders have launched multiple new perpetual markets through HIP-3, expanding Hyperliquid’s ecosystem to include equity-style trading options alongside its existing crypto derivatives offerings.